All Categories

Featured

Table of Contents

The strategy has its very own advantages, yet it additionally has concerns with high fees, complexity, and a lot more, resulting in it being considered as a fraud by some. Limitless financial is not the very best policy if you require only the investment part. The infinite banking idea revolves around making use of whole life insurance plans as an economic tool.

A PUAR allows you to "overfund" your insurance plan right as much as line of it coming to be a Customized Endowment Contract (MEC). When you use a PUAR, you quickly raise your cash money value (and your fatality benefit), thereby increasing the power of your "bank". Further, the more money value you have, the greater your interest and dividend settlements from your insurer will certainly be.

With the surge of TikTok as an information-sharing system, economic recommendations and strategies have discovered a novel method of dispersing. One such strategy that has been making the rounds is the limitless banking idea, or IBC for short, gathering endorsements from celebs like rapper Waka Flocka Fire - Borrowing against cash value. However, while the approach is currently preferred, its origins map back to the 1980s when economist Nelson Nash introduced it to the world.

Infinite Banking

Within these plans, the cash money value expands based upon a rate established by the insurer. As soon as a substantial cash money value builds up, policyholders can obtain a cash money worth finance. These car loans vary from standard ones, with life insurance coverage working as collateral, indicating one might shed their protection if borrowing exceedingly without adequate money value to support the insurance policy prices.

And while the allure of these policies is evident, there are natural constraints and dangers, requiring diligent cash worth tracking. The method's authenticity isn't black and white. For high-net-worth individuals or local business owner, especially those making use of strategies like company-owned life insurance policy (COLI), the advantages of tax obligation breaks and compound development can be appealing.

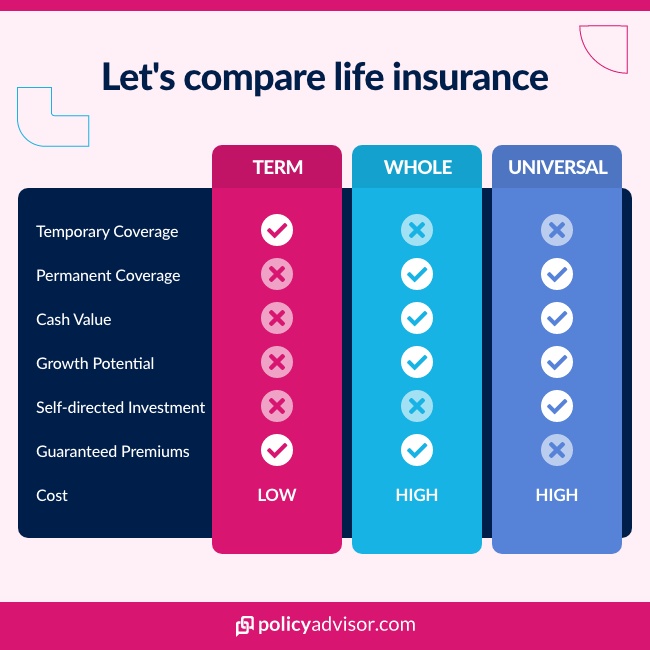

The attraction of infinite financial doesn't negate its difficulties: Cost: The fundamental requirement, a permanent life insurance policy plan, is pricier than its term counterparts. Eligibility: Not everyone receives entire life insurance policy due to extensive underwriting processes that can omit those with certain health and wellness or way of life problems. Intricacy and risk: The detailed nature of IBC, combined with its risks, may discourage numerous, particularly when easier and much less high-risk choices are readily available.

How flexible is Privatized Banking System compared to traditional banking?

Allocating around 10% of your month-to-month earnings to the policy is just not feasible for many people. Part of what you check out below is merely a reiteration of what has actually already been claimed over.

Before you get yourself right into a scenario you're not prepared for, understand the complying with first: Although the principle is commonly offered as such, you're not in fact taking a loan from yourself. If that were the case, you wouldn't have to repay it. Instead, you're obtaining from the insurer and need to settle it with interest.

Some social media blog posts suggest utilizing cash money worth from entire life insurance to pay for charge card financial obligation. The idea is that when you pay off the loan with passion, the quantity will be returned to your investments. However, that's not how it functions. When you repay the financing, a portion of that interest mosts likely to the insurance provider.

How long does it take to see returns from Infinite Banking?

For the initial a number of years, you'll be settling the payment. This makes it incredibly tough for your plan to gather value throughout this time. Whole life insurance policy expenses 5 to 15 times more than term insurance coverage. Many people simply can't afford it. Unless you can afford to pay a few to several hundred bucks for the next years or even more, IBC will not function for you.

Not everybody should rely solely on themselves for economic protection. Borrowing against cash value. If you require life insurance coverage, here are some important ideas to take into consideration: Consider term life insurance policy. These policies provide coverage throughout years with significant financial obligations, like home mortgages, pupil fundings, or when caring for children. See to it to search for the best rate.

What type of insurance policies work best with Life Insurance Loans?

Think of never having to worry concerning bank financings or high rate of interest rates again. That's the power of limitless financial life insurance coverage.

There's no collection car loan term, and you have the flexibility to decide on the settlement routine, which can be as leisurely as paying back the lending at the time of death. This versatility includes the maintenance of the lendings, where you can select interest-only settlements, keeping the financing balance level and manageable.

How do I leverage Infinite Banking Concept to grow my wealth?

Holding cash in an IUL repaired account being attributed rate of interest can usually be far better than holding the cash money on down payment at a bank.: You've constantly desired for opening your very own bakeshop. You can obtain from your IUL policy to cover the preliminary expenditures of renting an area, purchasing equipment, and employing team.

Personal finances can be gotten from standard banks and credit scores unions. Borrowing cash on a credit card is typically very pricey with annual percentage rates of passion (APR) commonly reaching 20% to 30% or even more a year.

Table of Contents

Latest Posts

What financial goals can I achieve with Infinite Banking Vs Traditional Banking?

How does Infinite Banking Retirement Strategy compare to traditional investment strategies?

What resources do I need to succeed with Financial Independence Through Infinite Banking?

More

Latest Posts

What financial goals can I achieve with Infinite Banking Vs Traditional Banking?

How does Infinite Banking Retirement Strategy compare to traditional investment strategies?

What resources do I need to succeed with Financial Independence Through Infinite Banking?